Phantom Debt Terror: The $7.6 Million Scam Empire Threatening Arrest for Debts That Don't Exist

The phone call came at Sarah's workplace on a Tuesday morning, shattering her day with five words that sent ice through her veins: "This is an investigator from Taos County New Mexico." The man claimed he was 30 minutes away from her high school, ready to serve her with a summons in front of her students and colleagues for a debt from 2005 that she had actually paid off in 2008.

"You have 30 minutes to call this number or I'll have to make a 'scene' at the school," he threatened, his voice dripping with authority and menace.

Sarah, a dedicated teacher who had never been in legal trouble, felt her world collapsing. The caller knew where she worked, had specific details about her financial history, and spoke with the confidence of someone with real power. In those terrifying 30 minutes, Sarah nearly became another victim of America's most psychologically brutal scam: phantom debt collection.

The debt was fake. The investigator was fake. The legal threat was fake. But the terror was absolutely real.

The Devastating Reality: Phantom debt collection has become a billion-dollar criminal industry, with scammers terrorizing Americans by threatening arrest, lawsuit, and wage garnishment for debts that never existed. Recent federal actions have shut down operations that stole over $7.6 million from victims using fake legal threats, with debt collection complaints now accounting for nearly one-third of all consumer complaints to the FTC—an average of 145 complaints per day.

The Phantom Menace: When Fear Becomes Currency

The Perfect Crime Formula

Phantom debt collectors have perfected the art of psychological warfare, using a devastating combination of legitimate-sounding authority, personal information stolen from data breaches, and our deepest fears about legal consequences to extract money from innocent victims.

The Staggering Scale:

- $7.6 Million: Amount stolen by just one phantom debt operation (Global Circulation Inc.)

- 53,004 complaints: Debt collection complaints received by the FTC in 2020 alone

- 145 complaints per day: Average daily reports of abusive debt collection practices

- One-third: Proportion of all FTC consumer complaints related to debt collection

- $500 median loss: Typical amount victims pay for non-existent debts

The Criminal Evolution

What started as crude "pay or go to jail" phone calls has evolved into sophisticated criminal enterprises operating under multiple fake company names, complete with professional-sounding websites, fake legal documents, and detailed scripts designed to terrorize victims into immediate compliance.

Recent Federal Takedowns:

- Blackrock Services, Blackstone Legal Group, Capital Legal Services: Multiple fake companies operated by the same criminal network

- Global Circulation Inc.: Collected $7.6 million in bogus debt while threatening victims with jail time

- Viking Legal Services, Quest Legal Group: Additional fake companies in the phantom debt empire

These aren't small-time operators—they're organized criminal networks with the sophistication to fool even educated consumers.

The Anatomy of Fear: How Phantom Debt Scams Work

Stage 1: The Intelligence Gathering

Data Breach Goldmine: Criminals purchase personal information from massive data breaches at financial institutions, retailers, and online services. This gives them your name, address, phone number, and often partial Social Security numbers—enough information to sound legitimate.

Social Media Surveillance: Scammers conduct "detective work" on potential victims, gathering information from social media posts, public records, divorce proceedings, and other publicly available sources to create detailed victim profiles.

Targeting Algorithms: Criminal organizations use sophisticated targeting systems to identify vulnerable populations—people going through financial stress, recent divorcees, elderly individuals, and anyone who might be uncertain about their financial obligations.

Stage 2: The Authority Establishment

Fake Company Creation: Scammers operate under dozens of professional-sounding company names, often impersonating real law firms and legitimate businesses. Names like "Capital Legal Services" and "Blackstone Legal Group" are designed to sound official and intimidating.

Professional Presentation: These operations create convincing websites with legal disclaimers, professional graphics, and official-sounding language about debt collection procedures and legal consequences.

Multiple Identity Management: The same criminal network operates under numerous fake identities, allowing them to contact victims multiple times from different "companies" to increase pressure and create the illusion of widespread legal action.

Stage 3: The Terror Campaign

The Opening Threat: Victims receive calls, letters, or emails claiming they owe money and face immediate legal consequences. The initial contact is designed to create maximum fear and confusion.

Escalating Intimidation: Follow-up communications increase the threats, claiming that victims have "defrauded a financial institution," could be "arrested at their workplace," or that their "homes could be seized" if they don't settle immediately.

Time Pressure Tactics: Scammers create artificial urgency, claiming that legal action will begin within hours or that special settlement offers expire quickly.

Stage 4: The Information Extraction

Verification Fishing: When victims question the debt, scammers ask for personal information "to verify the account"—actually collecting additional data for identity theft or to make their scam more convincing.

Financial Probing: Criminals ask about bank accounts, employment, and assets under the guise of setting up payment plans, gathering information for future targeting or identity theft.

Family Targeting: Scammers contact family members, claiming to collect debts and threatening legal action against loved ones, expanding their victim pool and increasing pressure.

Stage 5: The Financial Extraction

Payment Demands: Victims are pressured to pay immediately using untraceable methods—wire transfers, prepaid cards, or gift cards—that make recovery impossible.

Partial Payment Trap: Even small payments are victories for scammers, as they validate the victim's information and demonstrate vulnerability for future targeting.

Never-Ending Cycle: Successful victims often face repeated contact from the same criminal network operating under different fake company names.

Real Victims, Real Terror: The Human Cost of Phantom Debt

The Teacher's Nightmare

Sarah's experience with the fake "investigator from Taos County" represents thousands of similar cases where scammers target people at their workplaces, exploiting professional reputation concerns to force compliance.

The psychological impact was devastating: "This is completely unprofessional and a scam! They didn't even know my home address," Sarah later realized. But in those terrifying moments, the threat felt real enough to nearly destroy her career and financial security.

The Payday Loan Trap

According to Better Business Bureau reports, victims across the country received official-looking letters claiming they had defaulted on payday loans they never took out. The letters threatened lawsuits, wage garnishment, and other "scary consequences" for debts that existed only in the scammers' computers.

These victims faced a cruel choice: pay hundreds of dollars for debts they didn't owe, or risk the legal consequences threatened in professional-looking legal documents.

The Family Harassment Campaign

One of the most psychologically damaging aspects of phantom debt collection is the targeting of family members. Victims report scammers calling their relatives, threatening legal action and making similar demands for payment, often continuing these calls even after contacting the primary victim.

This family harassment serves multiple purposes:

- Increases pressure on the primary victim

- Expands the pool of potential payers

- Creates social embarrassment and shame

- Damages family relationships and trust

The Seven Deadliest Phantom Debt Scam Types

1. The Fake Payday Loan Collection

The Setup: Victims receive official-looking letters or calls claiming they defaulted on payday loans they never took out. The documents include detailed account numbers, dates, and legal terminology.

The Pressure: Scammers threaten immediate legal action, wage garnishment, and damage to credit scores if the fake debt isn't paid within days.

The Truth: These "debts" are completely fabricated, but the legal threats sound real enough to terrify victims into paying.

Red Flags:

- You never took out a payday loan

- The amount owed seems arbitrary or rounded

- Payment must be made via untraceable methods

- No detailed payment history is available

2. The Credit Card "Charge-Off" Scam

The Deception: Criminals claim to be collecting on old credit card debts that were "charged off" by major banks. They use real bank names and account-sounding numbers to add legitimacy.

The Hook: Scammers often target people who have had credit issues in the past, making the fake debt seem plausible.

The Threat: Victims are told they'll face lawsuits, wage garnishment, and arrest if they don't settle immediately for a fraction of the alleged debt.

Warning Signs:

- No detailed account history provided

- Pressure for immediate settlement

- Threats of criminal prosecution for civil debt

- Refusal to provide written verification

3. The Medical Bill Phantom

The Scheme: Scammers claim victims owe money for medical procedures, emergency room visits, or specialist consultations they never received.

The Psychology: Medical debt is common and often confusing, making victims more likely to believe they might owe money they forgot about.

The Threats: Collections agents claim the debt will be turned over to attorneys, affect credit scores, or result in legal action against the victim.

Detection Tips:

- You have no memory of the medical service

- The provider name is vague or unfamiliar

- No insurance claims or explanations of benefits exist

- Payment demands are immediate and inflexible

4. The Utility Bill Fabrication

The Story: Victims receive calls claiming they owe money on old utility bills from apartments they never lived in or services they never used.

The Authority: Scammers may claim to represent major utility companies and threaten service disconnection or legal action.

The Urgency: Victims are told they have hours to pay before legal proceedings begin or their current utility service is affected.

Identification Clues:

- Bills for addresses you never lived at

- Services you never used or needed

- Threats to disconnect current service for old bills

- Demands for immediate payment via gift cards

5. The Student Loan Terror

The Approach: Criminals claim victims owe money on student loans that were never paid off, often targeting people who actually did have student loans but paid them off years ago.

The Confusion: Student loan regulations are complex, making victims uncertain about their actual obligations and payment history.

The Consequences: Scammers threaten wage garnishment, tax refund seizure, and damaged credit scores—all real consequences of actual student loan default.

Verification Methods:

- Check with your actual loan servicer directly

- Review your credit report for any active student loans

- Contact the Department of Education for federal loan information

- Never pay based solely on phone calls or letters

6. The Business Debt Scam

The Target: Small business owners receive calls about fake debts for services never received, supplies never ordered, or business loans never taken out.

The Pressure: Scammers threaten to ruin business credit, file liens against business property, or report the business to regulatory agencies.

The Time Crunch: Business owners are told they have limited time to settle before facing serious business consequences.

Business Protection:

- Maintain detailed records of all business transactions

- Verify all claimed debts through your own accounting records

- Contact alleged creditors directly using known contact information

- Never pay business debts based solely on unsolicited calls

7. The Legal Fee Fabrication

The Fiction: Victims are told they owe money for legal services they never received, court fees for cases they were never involved in, or fines for violations they never committed.

The Authority: Scammers may impersonate court officials, attorneys, or legal collection agencies to add credibility to their demands.

The Consequences: Victims are threatened with contempt of court charges, additional legal fees, or arrest warrants if they don't pay immediately.

Legal Reality Check:

- Courts send official notices through certified mail, not phone calls

- Real legal fees come with detailed billing and service records

- Court fines are processed through official court systems

- No legitimate legal collection involves gift cards or wire transfers

The Federal War Against Phantom Debt Criminals

Recent Major Takedowns

Global Circulation Inc. Bust: In November 2024, the FTC shut down a Georgia-based operation that collected over $7.6 million in bogus debt by threatening victims with jail time and harassing family members. The court ordered the company's assets turned over to a receiver.

Phantom Debt Collection Network: In March 2025, federal action halted operations under numerous names including Blackrock Services, Blackstone Legal Group, and Capital Legal Services, freezing assets of a scheme that threatened arrest and home seizure for non-existent debts.

Multi-State Coordination: The FTC has established working relationships with 48 state attorneys general to combat phantom debt collection, recognizing this as a national crisis requiring coordinated response.

The Enforcement Challenge

Whack-a-Mole Operations: Criminal networks simply create new fake company names when old ones are shut down, making it difficult to stop them permanently.

International Reach: Many phantom debt operations are based overseas or use international communication systems, making prosecution difficult.

Victim Reluctance: Many victims are too embarrassed to report phantom debt scams, believing they should have known better, which reduces the available evidence for prosecution.

How to Build an Impenetrable Phantom Debt Defense

The Golden Rules of Debt Verification

Rule #1: Demand Written Validation: Legitimate debt collectors must provide written validation within five days of first contact. This includes the creditor's name, amount owed, and your right to dispute the debt.

Rule #2: Never Pay Without Proof: No matter how convincing the threats, never pay any debt without first receiving and verifying detailed documentation of what you allegedly owe.

Rule #3: Verify the Collector: Contact the original creditor directly using phone numbers from your own records or official websites, not numbers provided by the collector.

Rule #4: Know Your Rights: Under the Fair Debt Collection Practices Act, collectors cannot lie, threaten you with things they can't do, or pose as government officials.

Rule #5: Document Everything: Keep records of all communications, including phone calls, letters, and emails. This documentation is crucial for reporting scams and protecting yourself legally.

The Phantom Debt Detection System

Red Flag #1: Unrecognized Debt If you don't recognize the debt at all, it's likely fake. Legitimate debts come with detailed histories and documentation.

Red Flag #2: Immediate Payment Demands Scammers want payment before you have time to verify the debt. Legitimate collectors work within legal timeframes.

Red Flag #3: Untraceable Payment Methods Demands for wire transfers, gift cards, or prepaid cards are almost always scams. Legitimate collectors accept checks and traditional payment methods.

Red Flag #4: Arrest Threats You cannot be arrested for failing to pay consumer debt. Any threat of arrest is a clear sign of a scam.

Red Flag #5: Workplace Threats Collectors cannot legally threaten to contact your employer about the debt or embarrass you at work.

Red Flag #6: Family Harassment Legitimate collectors can only contact family members to locate you, not to discuss your debt or demand payment.

Red Flag #7: Refusal to Provide Information If collectors won't give their name, company information, or written verification, they're likely running a scam.

Advanced Verification Techniques

The Credit Report Check: Get your free annual credit report from AnnualCreditReport.com to see what debts are actually on your file. Phantom debts won't appear on legitimate credit reports.

The Original Creditor Contact: Call the company you allegedly owe money to directly, using contact information from your own records or their official website. They can tell you if they've assigned your account to collectors.

The State Licensing Verification: Many states require debt collectors to be licensed. Ask for their license number and verify it with your state's regulatory agency.

The Written Dispute Process: Send a written dispute letter to any collector claiming you owe money. Legitimate collectors must stop collection efforts until they provide verification.

The Documentation Demand: Ask for detailed payment history, original contract terms, and proof of the collector's legal right to collect the debt.

What to Do If You're Under Phantom Debt Attack

During the Initial Contact

Stay Calm: Phantom debt collectors rely on panic and fear to bypass your rational thinking. Take deep breaths and remember that you have rights.

Don't Admit Anything: Don't confirm personal information, admit to owing money, or agree that the debt is yours. Simply listen and take notes.

Demand Identification: Get the caller's name, company name, address, phone number, and license number. Legitimate collectors provide this information willingly.

Ask Questions: How much is allegedly owed? Who is the original creditor? When did this debt supposedly originate? What is your legal right to collect this debt?

End the Call: Tell them you need written verification before discussing anything further and hang up. Legitimate collectors understand this requirement.

Immediate Protection Steps

Document Everything: Write down the date, time, caller's name, company name, and everything they said. This creates a record for reporting and legal protection.

Don't Pay Anything: No matter how convincing the threats, don't make any payments until you've thoroughly verified the debt through independent sources.

Contact the Original Creditor: If you think there might be any possibility the debt is real, contact the original creditor directly using your own contact information.

Check Your Credit Report: Review your credit report immediately to see if this debt appears anywhere in your legitimate credit history.

Warn Your Family: Alert family members that scammers may contact them with similar threats and demands.

Reporting and Recovery

Federal Reporting:

- FTC: File complaints at ReportFraud.ftc.gov for debt collection scams

- CFPB: Report to the Consumer Financial Protection Bureau for debt collection violations

- FBI IC3: Use the Internet Crime Complaint Center for criminal fraud reporting

State and Local Action:

- Contact your state attorney general's office

- File police reports for criminal threats and harassment

- Report to your state's debt collection licensing agency

Financial Protection:

- Place fraud alerts on your credit reports

- Monitor bank and credit card accounts for unauthorized activity

- Consider credit freezes if personal information was compromised

- Never provide additional personal information to verify fake debts

The Psychology of Phantom Debt Vulnerability

Why Smart People Fall Victim

Uncertainty About Personal Finances: Many people aren't 100% certain about their financial history, making them vulnerable to claims about forgotten debts or old obligations.

Fear of Legal Consequences: The threat of arrest, lawsuits, or wage garnishment triggers panic responses that override rational thinking.

Authority Bias: When someone calls claiming to be from a law firm or collection agency, we're conditioned to take them seriously and comply with their demands.

Information Advantage: Scammers often have enough personal information from data breaches to sound legitimate, making their claims seem credible.

Embarrassment Factor: The shame associated with debt problems makes victims more likely to pay quickly and quietly rather than verify the claims.

The Emotional Manipulation Playbook

Fear: "You'll be arrested if you don't pay today" Shame: "Your family and employer will find out about this debt" Urgency: "This is your last chance before we file legal papers" Authority: "I'm calling from the legal department" Isolation: "You can't discuss this with anyone else" Helplessness: "There's nothing you can do except pay now"

The Future of Phantom Debt: Emerging Threats

Technology Enhancement

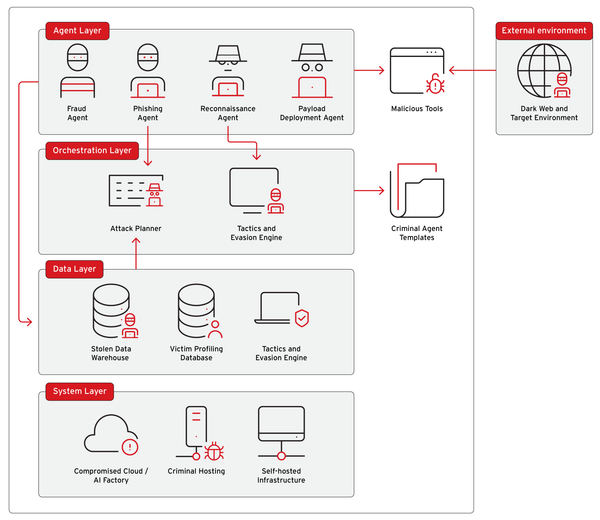

AI-Powered Personalization: Criminals are using artificial intelligence to create more personalized and convincing scam approaches based on victim data profiles.

Deepfake Documentation: Future phantom debt scams may include fake audio recordings or video "evidence" of victims agreeing to debts they never incurred.

Automated Harassment: Technology allows scammers to conduct massive automated calling campaigns, reaching more victims with less effort.

Regulatory Response

Enhanced Penalties: Federal and state authorities are increasing penalties for phantom debt collection and expanding enforcement resources.

Better Consumer Education: Government agencies are launching more comprehensive public education campaigns about debt collection rights and scam recognition.

Technology Solutions: New systems are being developed to help consumers verify legitimate debts and identify fake collectors more easily.

International Cooperation

Cross-Border Enforcement: Law enforcement agencies are developing better international cooperation to pursue phantom debt criminals operating from overseas.

Data Sharing: Improved information sharing between countries helps track criminal networks and prevent their expansion.

Conclusion: Your Financial Fortress Against Phantom Fear

Phantom debt collection represents one of the cruelest forms of financial fraud, weaponizing our deepest anxieties about legal consequences and financial responsibility to extract money we don't owe for debts that never existed. These aren't simple phone scams—they're sophisticated psychological warfare campaigns designed to bypass rational thinking and trigger panic responses.

The criminal enterprises behind phantom debt collection have evolved into billion-dollar operations with professional websites, fake legal documents, and detailed victim profiles purchased from data breaches. They study human psychology, exploit our fears, and use our own financial uncertainty against us.

The Human Cost: Beyond the hundreds of millions stolen annually, phantom debt scams destroy something more precious than money—they erode trust in legitimate financial institutions and create lasting trauma around financial communications. Victims often become paranoid about all debt collection contacts, even legitimate ones.

The Legal Reality: You cannot be arrested for consumer debt. You cannot be sued in any county other than where you lived when you signed a contract. Legitimate collectors cannot threaten you with things they cannot do. These fundamental truths are your shield against phantom debt terror.

The Power of Knowledge: Every phantom debt scammer counts on your ignorance of debt collection laws and your fear of legal consequences. But knowledge destroys their power. When you know your rights, understand the verification process, and recognize the red flags, their threats become empty words.

The Verification Protocol: The single most powerful weapon against phantom debt is the simple demand for written verification. Legitimate collectors welcome verification requests—scammers flee from them. Never pay any debt without first demanding and receiving detailed written proof of what you owe and why.

The Community Defense: Protecting yourself from phantom debt requires community awareness. Elderly relatives, friends going through financial stress, and anyone who might be vulnerable to these psychological attacks needs to know about this threat and understand their rights.

The Golden Rules for Phantom Debt Defense:

- Demand written verification before any payment - It's your legal right and scammers can't provide it

- You cannot be arrested for consumer debt - Any arrest threat is a scam

- Contact original creditors directly - Use your own contact information, not numbers provided by collectors

- Document all communications - Keep records of every interaction for reporting and protection

- Never pay via untraceable methods - Wire transfers, gift cards, and prepaid cards are scam payment methods

- Trust your instincts - If something feels wrong, it probably is

The Bottom Line: In 2025, phantom debt collectors are counting on your fear to override your judgment. They bet that the threat of arrest, legal action, or public embarrassment will make you pay without verification. But they have a fatal weakness: they can't provide proof of debts that don't exist.

When someone calls demanding payment for a debt you don't recognize, your first question shouldn't be "How much do I owe?" It should be "Can you prove I owe anything at all?" That simple shift from fear to verification is the difference between becoming a victim and remaining protected.

The phantom debt criminals may have sophisticated technology, stolen personal information, and psychological manipulation techniques. But they can't create proof of debts that never existed. And that's why knowledge, verification, and the courage to demand proof will always defeat phantom debt terror.

Your financial security isn't just about the money in your accounts—it's about knowing when to pay and when to resist. In the age of phantom debt, resistance through verification isn't defiance—it's survival.

Phantom Debt Defense Kit

Immediate Response Protocol

- ☐ Stay calm and don't admit to owing anything

- ☐ Get collector's name, company, address, phone number

- ☐ Ask for license number and written verification

- ☐ End the call and hang up

- ☐ Document everything immediately

Verification Checklist

- ☐ Check your credit reports for this debt

- ☐ Contact the original creditor directly

- ☐ Send written dispute letter if needed

- ☐ Demand detailed payment history

- ☐ Verify collector's licensing with state authorities

Red Flag Alert

- ☐ Threats of arrest for consumer debt

- ☐ Demands for immediate payment

- ☐ Requests for wire transfers or gift cards

- ☐ Refusal to provide written verification

- ☐ Threats to contact employer or family

- ☐ Pressure tactics and time limits

Legal Rights Reminder

- ☐ You cannot be arrested for consumer debt

- ☐ Collectors must provide written verification

- ☐ You have the right to dispute any debt

- ☐ Collectors cannot harass or threaten you

- ☐ You can demand they stop calling you

Emergency Contacts

- FTC Fraud Reporting: ReportFraud.ftc.gov

- Consumer Financial Protection Bureau: consumerfinance.gov/complaint

- FBI Internet Crime Center: ic3.gov

- Free Credit Reports: AnnualCreditReport.com

- Your State Attorney General: For local enforcement and protection