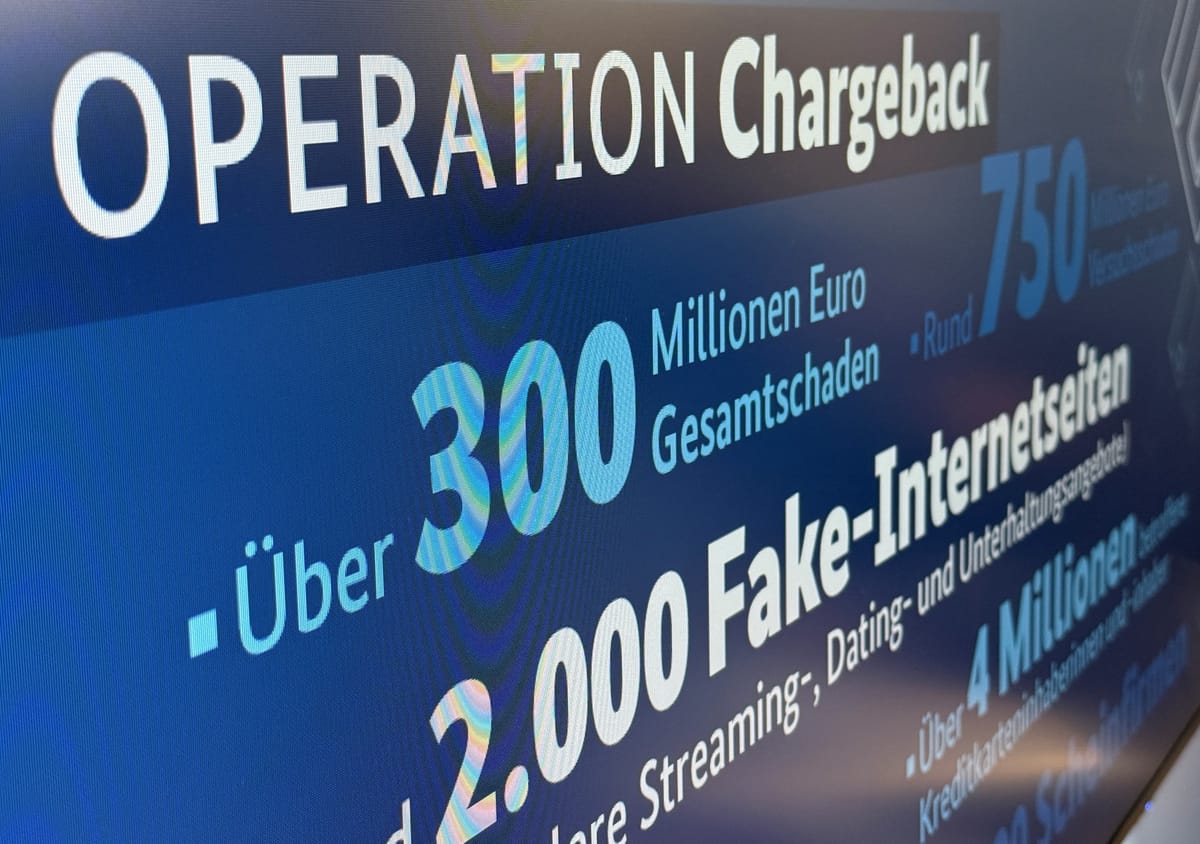

Operation Chargeback: Global Law Enforcement Dismantles EUR 300 Million Credit Card Fraud Empire

International crackdown exposes payment industry corruption as 18 arrested in sophisticated subscription scam affecting 4.3 million victims across 193 countries

Executive Summary

In one of the most significant cybercrime enforcement actions of 2025, international law enforcement coordinated by Eurojust executed Operation Chargeback on November 4, resulting in 18 arrests and the dismantling of three criminal networks that defrauded 4.3 million credit card holders across 193 countries of at least EUR 300 million between 2016 and 2021.

The operation, which involved authorities from Germany, the United States, Canada, Singapore, Luxembourg, Cyprus, Spain, Italy, the Netherlands, and the United Kingdom, exposed not just the criminal networks but a shocking level of corruption within the legitimate payment processing industry itself.

Key Figures:

- EUR 300 million: Confirmed stolen from victims

- EUR 750 million: Total attempted fraud

- 4.3 million: Cardholders affected

- 193 countries: Global reach of the fraud

- 19 million: Fake subscription accounts created

- 18 arrests: Including 5 payment industry executives

- 60+ searches: Coordinated across 10 countries

- EUR 35 million: Assets seized in Germany and Luxembourg alone

The Fraud Scheme: Designed to Evade Detection

How the Scam Operated

Between 2016 and 2021, the criminal networks created approximately 19 million fraudulent online subscriptions through deceptive websites offering pornography, dating, and streaming services. The sophistication of the scheme lay not in its complexity, but in its psychological manipulation of victim behavior.

The Subscription Trap:

The perpetrators deliberately kept monthly credit card payments below EUR 50 to avoid arousing suspicion among victims about high transfer amounts. This threshold was carefully calculated—small enough to slip past casual review of bank statements, but large enough to generate massive profits when multiplied across millions of victims.

The payments had obscure descriptions, making it difficult for victims to trace them. Billing descriptors would appear as vague merchant names or cryptic abbreviations that gave no indication they were linked to adult content or dating services—a deliberate tactic to prevent victims from recognizing unauthorized charges.

Technical Obfuscation

The websites were developed in such a way that they could not be indexed via search engines and were only accessible via direct links or URLs. This "dark web lite" approach meant that even if victims suspected fraud, they couldn't easily locate the supposed merchant to dispute charges or verify legitimacy.

The criminal infrastructure was designed with multiple layers of protection:

- No search engine visibility

- Direct URL access only

- Obscure billing descriptors

- Amounts below typical fraud alert thresholds

- Websites mimicking legitimate subscription services

The Payment Industry Betrayal

Executive Complicity Shocks Investigators

Perhaps the most disturbing revelation from Operation Chargeback is the extent of corruption within legitimate payment service providers. The infrastructure of four payment providers was exploited to process and launder the illicit proceeds of the fraud, with five arrested suspects who were employed by the payment services—including executives and compliance officers—allegedly colluding with the fraud networks to use the financial infrastructure in exchange for fees.

This represents a catastrophic failure of the financial system's internal controls. The very individuals tasked with preventing fraud and ensuring regulatory compliance instead became active participants in the criminal scheme.

Who Was Arrested:

Among the 18 arrested were five executives from four German payment service providers, with six total suspects including compliance staff accused of knowingly enabling network access in exchange for fees. These weren't rogue low-level employees—these were senior decision-makers who understood exactly what they were facilitating.

The Money Laundering Infrastructure

The suspects used a series of shell companies, mainly registered in Cyprus and the United Kingdom, to conceal their activities and distribute the fraudulent transactions. This corporate structure served multiple criminal purposes:

- Chargeback Prevention: By distributing transactions across multiple merchant accounts, the networks minimized the risk that any single entity would trigger fraud alerts

- Regulatory Arbitrage: UK and Cyprus corporate structures provided legitimacy while maintaining opacity

- Asset Protection: Shell company layers made it difficult to trace and seize criminal proceeds

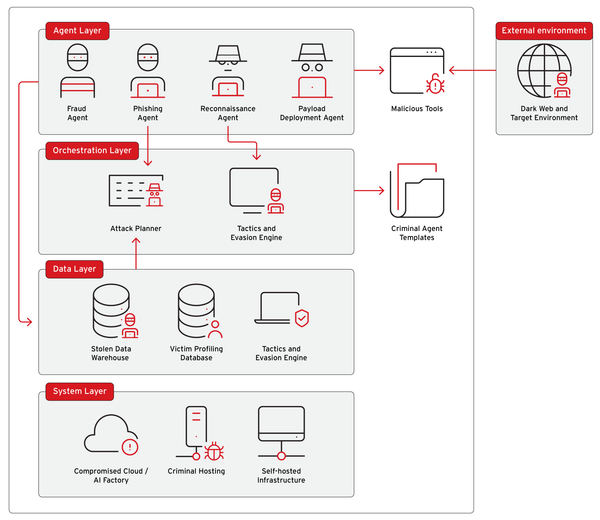

These companies were obtained via so-called Crime-as-a-Service providers, who assist criminals with their illegal activities against a fee, providing complete corporate structures including fake directors and falsified Know-Your-Customer (KYC) documents.

The involvement of Crime-as-a-Service platforms represents the industrialization of financial fraud—criminal infrastructure now available as a turnkey solution, complete with fraudulent compliance documentation.

The Investigation: Five Years of International Cooperation

Origins and Coordination

The operation was led by the Cybercrime Department of the General Prosecutor's Office in Koblenz, Germany, and the German Federal Criminal Police Office (Bundeskriminalamt), which had been investigating these networks since December 2020.

The complexity of the international operation required unprecedented coordination:

Eurojust's Role: Eurojust organised four coordination meetings to prepare for the action day and enabled cross-border judicial cooperation with the United Kingdom and the United States via their Liaison Prosecutors, and with authorities in Canada and Singapore via its network of Contact Points. The Agency also assisted with the execution of 90 European Investigation Orders and requests for Mutual Legal Assistance to 30 countries.

U.S. Contribution: German authorities received crucial information, obtained by Mutual Legal Assistance, from a related U.S. investigation led by the United States Attorney's Office for the Southern District of New York, which enabled the General Public Prosecutor's Office of Koblenz to proceed with their investigations and uncover the overall fraud scheme and determine further suspects.

Europol Support: Europol provided substantial analytical support since May 2023, organizing operational meetings and identifying suspects across jurisdictions, and deployed cryptocurrency experts during the action.

The November 4 Action Day

The coordinated strike involved massive resources:

More than 60 house searches were conducted across Germany, the USA, Canada, Singapore, Luxembourg, Cyprus, Spain, Italy, and the Netherlands.

German Operations: In Germany alone, investigators searched 29 premises across several Federal States and executed five arrest warrants, with over 250 officers from the Federal Criminal Police Office, the Public Prosecutor General's Office in Koblenz, the Federal Financial Supervisory Authority (BaFin), and the tax investigation unit involved.

Assets Seized: Authorities seized cryptocurrencies, luxury vehicles, mobile phones, laptops, various communication tools, and documents, with German officials securing assets worth over EUR 35 million in Germany and Luxembourg.

Who Were the Criminals?

International Criminal Networks

The arrested persons include German, Lithuanian, Dutch, Austrian, Danish, American and Canadian nationals. The fraud was organised around three networks, which defrauded several million credit card users with 19 million accounts in 193 countries.

The investigation identified approximately 44 suspects total, with 18 arrested on the action day and others remaining under investigation.

Criminal Charges

Approximately 44 suspects face charges including computer fraud, criminal organization membership, and money laundering. The involvement of payment service executives adds additional charges related to breach of fiduciary duty and regulatory violations.

How Victims Were Targeted

The Data Theft Operation

Between 2016 and 2021, the suspects were allegedly involved in stealing credit card data, setting up fake accounts, authorising and concealing payments, and money laundering.

The initial compromise of credit card data likely occurred through multiple vectors:

- Data breaches of legitimate merchants

- Skimming operations

- Phishing campaigns

- Purchases from dark web carding forums

The Subscription Enrollment Process

Once credit card data was obtained, the networks would:

- Create fake accounts on their hidden subscription websites

- Process small recurring charges that appeared legitimate

- Use obscure billing descriptors to hide the true nature of charges

- Route payments through complicit payment processors who looked the other way

- Distribute transactions across shell companies to avoid detection patterns

The victims would often only discover the fraud months later, if at all, as the charges were designed to blend into normal subscription spending patterns.

Red Flags: How to Spot Similar Scams

Based on the Operation Chargeback case, consumers should watch for:

Warning Signs on Your Credit Card Statement

- Small recurring charges (EUR 20-50/month) from unfamiliar merchants

- Vague merchant descriptions that don't clearly identify the service

- Multiple small charges from different merchants you don't recognize

- Charges that started without your knowledge for "subscription services"

- Merchants whose websites can't be found through normal search engines

If You Suspect Fraud

Immediate Actions:

- Contact your credit card issuer immediately to dispute unauthorized charges

- Request a new card number

- File a police report

- Document all fraudulent charges with dates, amounts, and merchant names

- Check all other accounts for similar suspicious activity

Prevention Measures:

- Enable transaction alerts for all charges above EUR 1

- Review statements weekly, not monthly

- Use virtual card numbers for online subscriptions

- Maintain a spreadsheet of legitimate subscriptions with expected amounts

- Consider using a dedicated card for online purchases to isolate exposure

Implications for the Payment Industry

Regulatory Failures Exposed

The Operation Chargeback case reveals catastrophic failures in payment industry oversight. When executives and compliance officers at multiple payment service providers actively participate in fraud, it suggests systemic vulnerabilities in:

- Internal Controls: How can payment processors operate when senior leadership is compromised?

- Regulatory Supervision: Where was BaFin (Germany's financial regulator) during the five years this scheme operated?

- Industry Self-Regulation: Payment card networks' fraud detection systems failed to identify patterns affecting millions of cardholders

- KYC/AML Compliance: Shell companies with fake documentation passed through supposedly rigorous vetting

Questions for Payment Processors

Every payment service provider should now answer:

- How do you verify that merchant accounts are legitimate?

- What controls prevent executives from overriding fraud alerts?

- How are compliance officers monitored to ensure they aren't compromised?

- What transaction patterns trigger investigation of merchant accounts?

- How do you validate corporate documents from high-risk jurisdictions?

The Crime-as-a-Service Threat

The use of Crime-as-a-Service providers offering complete corporate structures, fake directors and KYC documents represents an escalating threat. These platforms have industrialized financial crime, making sophisticated fraud accessible to criminals who lack technical expertise.

Law enforcement and regulators must address:

- Platforms offering shell company services

- Document falsification services

- Nominee director services

- KYC document fabrication

Law Enforcement Statements

Europol Executive Director Catherine De Bolle: "By leveraging our analytical capabilities and facilitating cross-border coordination, we have been able to bring down the networks defrauding millions of credit card users worldwide".

Martina Link, Vice President of the German Federal Criminal Police Office: "With the successful investigations to identify the criminal networks and the resulting arrests, German and international authorities have dealt a significant blow to the global financial fraud scene".

EU Commissioner for Internal Affairs and Migration Magnus Brunner: Brunner highlighted the role of cross-border cooperation and the need to strengthen efforts against serious and organized crime, stressing that "over 85 percent of investigations rely on online evidence, and without this data, the fight against crime cannot be effective".

What Happens Next?

Ongoing Investigation

The Operation Chargeback investigation continues. Authorities are analyzing seized evidence, tracking additional suspects, and working to recover stolen funds. Law enforcement agencies are expected to continue tracking the stolen funds and identifying remaining accomplices.

Victim Notification

With 4.3 million victims across 193 countries, the notification process will be extensive. Payment card networks and issuers are working to identify affected cardholders and process reimbursements.

Industry Reform

This case should trigger:

- Enhanced scrutiny of payment service provider internal controls

- Stricter regulation of shell company formation in Cyprus and the UK

- Improved cross-border information sharing on merchant fraud

- Mandatory compliance officer background checks and monitoring

- Industry-wide review of fraud detection systems

Lessons for Consumers

Operation Chargeback demonstrates that financial fraud can persist for years, affecting millions, even when operating through supposedly regulated payment systems. The betrayal by payment industry insiders makes clear that consumers cannot rely solely on institutional safeguards.

Key Takeaways:

- Small recurring charges deserve as much scrutiny as large ones

- Vague merchant names are often deliberate obfuscation

- Payment processors can be part of the problem, not the solution

- Regular statement review is your first line of defense

- Transaction alerts provide real-time fraud detection

Your Rights:

- You cannot be held liable for unauthorized charges if reported promptly

- Credit card networks provide fraud protection (though processing disputes takes time)

- You can request detailed merchant information from your card issuer

- You have the right to cancel any subscription service immediately

ScamWatchHQ Analysis

Operation Chargeback exposes a disturbing reality: the payment industry cannot be trusted to police itself. When senior executives and compliance officers at multiple payment service providers actively facilitate fraud for years, it reveals that financial incentives have overwhelmed ethical obligations and regulatory requirements.

The sophistication of this scheme lay not in advanced technology, but in exploiting human psychology and institutional weaknesses:

- Small amounts that victims ignore

- Obscure descriptions that confuse

- Hidden websites that prevent verification

- Complicit payment processors who enable rather than prevent

- Shell company structures that obscure ownership

For consumers, the lesson is clear: vigilance cannot be outsourced. The institutions we trust to protect us from fraud may themselves be compromised. Regular statement review, transaction alerts, and healthy skepticism about small recurring charges are essential defenses in an environment where even regulated financial intermediaries can be corrupted.

The EUR 300 million stolen represents real harm—money taken from individuals' accounts, often discovered too late for easy recovery. The EUR 750 million in attempted fraud shows the true scope of the criminal ambition. That such a massive operation could persist from 2016 to 2021 without detection by payment industry fraud systems suggests that current safeguards are fundamentally inadequate.

Additional Resources

Report Fraud:

- Europol: https://www.europol.europa.eu/report-a-crime

- FBI IC3: https://www.ic3.gov (U.S. residents)

- Action Fraud: https://www.actionfraud.police.uk (UK residents)

- Local law enforcement: File a police report in your jurisdiction

Credit Card Fraud Protection:

- Contact your card issuer immediately if you identify unauthorized charges

- Request transaction alerts for all purchases

- Consider credit monitoring services

- Review the U.S. Fair Credit Billing Act or equivalent consumer protection laws in your country

Stay Informed:

- Follow ScamWatchHQ for ongoing coverage of financial fraud cases

- Subscribe to alerts from your national consumer protection agency

- Join online communities focused on fraud awareness and prevention

This article is based on official statements from Europol, Eurojust, and law enforcement agencies involved in Operation Chargeback. ScamWatchHQ will continue to monitor developments in this case and update our coverage as new information becomes available.

Related Articles from ScamWatchHQ:

- The Subscription Scam Maze: How Hidden Fees and Fake Cancellations Are Draining $2.8 Billion Annually

- Subscription and Membership Scams

- The Most Dangerous Scams of Q4 2025: What You Need to Know Right Now

- The QR Code Trap: How 'Quishing' Scams Are Costing Americans Millions in 2025

Related Articles from Breached.company:

- The 15 Most Devastating Data Breaches in History

- Operation SIMCARTEL: Europe Dismantles Massive Cybercrime-as-a-Service Network

- Global Cybercrime Crackdown: Major Law Enforcement Operations of 2024-2025

- DOJ Investigation Exposes Alleged Corruption in Ransomware Negotiation Industry

- The Most Common Methods Behind Major Data Breaches