Major Scam Networks Targeting Elderly Americans: A Comprehensive Analysis

Analyzing Recent Federal Cases and Emerging Threat Patterns

Published by ScamWatchHQ Research Team | September 10, 2025

Executive Summary

Three major scam operations targeting elderly Americans have recently been disrupted by federal authorities, revealing sophisticated criminal networks that have collectively stolen over $40 million from victims. These cases demonstrate evolving tactics that combine traditional phone scams with modern technology, international criminal organizations, and systematic targeting of vulnerable populations.

Key Findings:

- Phantom Hacker scams have cost Americans over $1 billion since 2024

- Digital asset investment scams laundered $36.9 million through international networks

- Southeast Asia-based scam centers cost Americans over $10 billion in 2024

- Elderly victims are increasingly targeted due to accumulated wealth and technological vulnerabilities

Case Analysis: Three Interconnected Scam Networks

1. The Phantom Hacker Conspiracy (Wisconsin)

Defendant: Ankurkumar Patel, 41, Brookfield, Wisconsin

Charges: Money laundering conspiracy, substantive money laundering

Amount: Over $1 million laundered from multiple elderly victims

The Scheme: The "Phantom Hacker" scam operates in three calculated phases: tech support imposter, financial institution imposter, and U.S. government imposter. Victims are initially contacted by scammers posing as customer service representatives from legitimate technology companies, who claim the victim's computer has been compromised by foreign hackers.

How It Works:

- Phase 1 - Tech Support Contact: Scammers contact victims via phone, email, or popup claiming their computer is infected or hacked

- Phase 2 - Bank Impersonation: A second scammer, posing as the victim's bank, claims their accounts have been compromised and money must be moved to "safe" government accounts

- Phase 3 - Government Authority: A final scammer impersonates federal agencies like the Federal Reserve to legitimize the previous calls and pressure victims into additional transfers

In Patel's case, he personally retrieved over $1 million from victims and conspired to launder the funds through anonymous transactions to other co-conspirators.

2. The International Investment Scam (California)

Key Defendant: Shengsheng He, 39, La Puente, California

Sentence: 51 months federal prison, $26.87 million restitution

Network: 8 co-conspirators across multiple countries

Amount: $36.9 million stolen from victims

The Operation: This international criminal network operated from scam centers in Cambodia and induced U.S. victims to transfer funds believing they were investing in digital assets. The scheme utilized multiple tactics:

Contact Methods:

- Unsolicited social media interactions

- Telephone calls and text messages

- Online dating services

- Personalized outreach to gain victim trust

Money Laundering Process: Over $36.9 million in victim funds were transferred to a single account at Deltec Bank in the Bahamas, converted to stablecoin Tether (USDT), and transferred to digital asset wallets controlled by individuals in Cambodia.

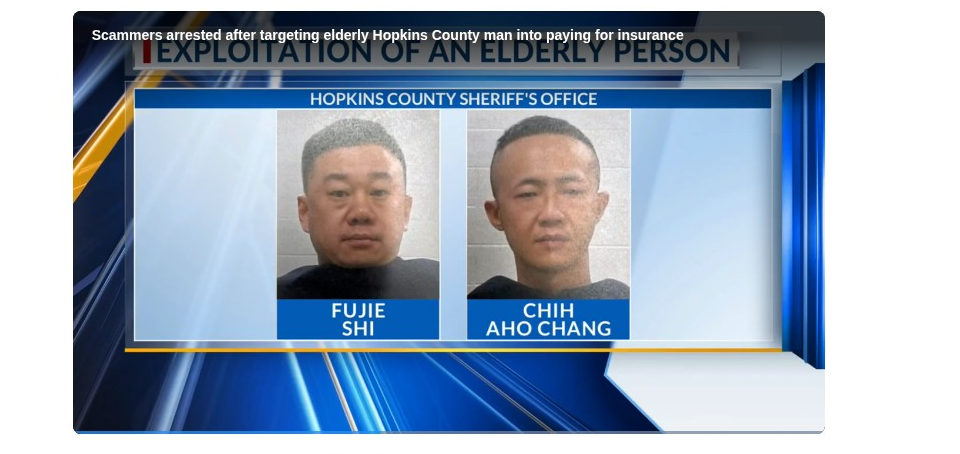

3. The FTD Insurance Fraud (Texas)

Defendants: Chih Hao Chang and Fujie Shi, both from Plano, Texas

Charges: Exploitation of the elderly and disabled

Method: Fake "FTD insurance" payments to supposed couriers

The Scam: An elderly Hopkins County man was convinced that his accounts had been hacked and needed to provide funds to a courier for "FTD insurance." This appears to be a variation of the phantom hacker scheme, using insurance terminology to legitimize fraudulent money transfers.

Threat Pattern Analysis

Common Targeting Factors

Demographic Vulnerabilities:

- Almost 50% of tech support scam victims reported to IC3 were over 60 years old, comprising 66% of total losses

- Older adults reported losing more than $1.9 billion to fraud in 2023, with the actual cost estimated at $61.5 billion

- Adults 60 and older were more than five times as likely as younger adults to report losing money to tech support scams

Financial Impact Escalation:

- From 2020 to 2024, reports from older adults who lost $10,000 or more increased more than fourfold

- Reports of losses over $100,000 increased nearly sevenfold in the same period

- Consumers 80 and older reported median losses of $1,450, while those in their seventies reported $804

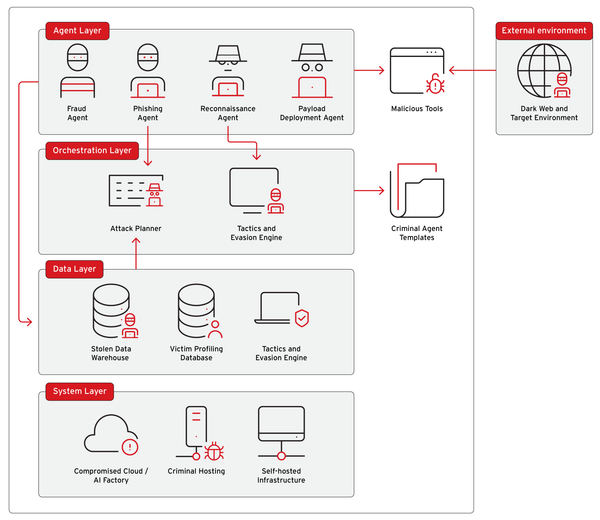

Technology-Enhanced Threats

AI and Personalization: Cybersecurity experts warn that scammers are now using artificial intelligence to create personalized messages and mimic real-life events, making attacks more effective. This technological advancement allows criminals to:

- Generate deepfake voices for phone calls

- Create personalized phishing emails based on social media analysis

- Develop more convincing impersonation tactics

- Automate victim targeting and communication

International Criminal Networks

Southeast Asian Operations: The Treasury Department has sanctioned large networks of scam centers across Southeast Asia, with Americans losing over $10 billion to these operations in 2024. These sophisticated operations feature:

- Forced labor conditions for scam workers

- Protection from corrupt local authorities

- Advanced money laundering through cryptocurrency

- Systematic targeting of U.S. victims

Interconnected Network Indicators

Shared Operational Patterns

While these three cases appear geographically distinct, they share several concerning patterns:

- Multi-Phase Psychological Manipulation: All three schemes use sequential authority figures to build credibility

- Technology Exploitation: Each operation leverages victims' limited technological knowledge

- International Money Laundering: Funds are quickly moved through complex international networks

- Elderly Targeting: All cases specifically target older adults with accumulated wealth

Potential Network Connections

Operational Similarities:

- Use of "government protection" narratives

- Sequential impersonation tactics

- International money movement patterns

- Emphasis on urgency and secrecy

Geographic Distribution: The cases span multiple states but show coordination in timing and methodology, suggesting possible oversight by larger criminal organizations.

Prevention and Protection Strategies

For Potential Victims

Immediate Red Flags:

- Unsolicited contact claiming computer problems or account breaches

- Requests to download software or allow remote computer access

- Instructions to move money for "protection" or "insurance"

- Pressure to act immediately without verification

- Requests for payment via cryptocurrency, wire transfers, or cash

Verification Protocols:

- Hang up and call back using official numbers from legitimate sources

- Never download software requested by unsolicited callers

- Verify independently any claims about account problems

- Consult trusted family members before making financial decisions

- Report suspicious contact to authorities immediately

For Family Members and Caregivers

Protective Measures:

- Designate a family member as a "trusted contact" for elderly relatives' financial accounts

- Establish regular family conversations about finances and scams

- Monitor for signs of exploitation or unusual financial activity

- Educate elderly family members about current scam tactics

For Financial Institutions

Detection Indicators:

- Unusual large withdrawals or transfers

- Requests for cryptocurrency purchases by elderly customers

- Multiple transactions to unfamiliar recipients

- Customer reports of "government" instructions to move money

Reporting and Resources

Immediate Reporting

- FBI Internet Crime Complaint Center: IC3.gov

- National Elder Fraud Hotline: 833-FRAUD-11 (833-372-8311)

- Federal Trade Commission: reportfraud.ftc.gov or 877-FTC-HELP

Support Resources

- Eldercare Locator: 800-677-1116

- Consumer Financial Protection Bureau: consumerfinance.gov

- AARP Fraud Watch Network: aarp.org/fraudwatchnetwork

Outlook and Recommendations

Emerging Threats

The convergence of artificial intelligence, international criminal networks, and sophisticated psychological manipulation represents an escalating threat to elderly Americans. With experts predicting even higher figures for 2025, enhanced prevention and enforcement efforts are critical.

Policy Implications

These cases highlight the need for:

- Enhanced international cooperation in cybercrime enforcement

- Improved financial institution reporting requirements

- Expanded elder fraud education programs

- Stronger penalties for exploitation of vulnerable populations

Community Action

For Families:

- Implement regular financial check-ins with elderly relatives

- Establish trusted contact protocols with financial institutions

- Educate about current scam tactics and prevention methods

For Financial Institutions:

- Train staff to recognize elder exploitation patterns

- Implement enhanced verification procedures for large transfers

- Develop age-appropriate fraud prevention communications

For Law Enforcement:

- Prioritize elder fraud cases for rapid investigation

- Enhance coordination with international partners

- Develop specialized elder fraud units

Conclusion

The recent federal cases in Wisconsin, California, and Texas reveal sophisticated criminal networks that are systematically targeting elderly Americans with increasingly complex and technologically advanced schemes. These operations have evolved far beyond simple phone scams to become international criminal enterprises using artificial intelligence, cryptocurrency, and psychological manipulation to steal billions from vulnerable victims.

The pattern of targeting elderly Americans reflects both their accumulated wealth and perceived technological vulnerabilities. However, with phantom hacker scams alone costing Americans over $1 billion since 2024, the scale of this threat demands coordinated response from families, financial institutions, and law enforcement.

Key Takeaways:

- These are not isolated incidents but part of larger international criminal networks

- Technology is being weaponized to make scams more convincing and harder to detect

- Early intervention and education remain the most effective protection strategies

- Rapid reporting can help prevent additional victims and aid in prosecution

As these criminal networks continue to evolve, vigilance, education, and coordinated prevention efforts will be essential to protect America's elderly population from financial exploitation.

For the latest scam alerts and prevention tips, visit ScamWatchHQ.com or follow us on social media. If you or someone you know has been targeted by these or similar scams, report it immediately to the appropriate authorities.

Sources: FBI Internet Crime Complaint Center, U.S. Department of Justice, Federal Trade Commission, Treasury Department Office of Foreign Assets Control