2026 Scam Trends: Your Essential End-of-Year Protection Guide

As we close out 2025 and head into 2026, scammers are evolving their tactics faster than ever before. The integration of artificial intelligence into fraud operations has fundamentally changed the scam landscape, making traditional warning signs like poor grammar and suspicious emails increasingly obsolete. Understanding these emerging threats is crucial for protecting yourself, your finances, and your personal information in the year ahead.smallbusinessanswers+1

The AI Revolution in Fraud

Artificial intelligence has transformed how scammers operate, enabling them to create highly personalized and convincing attacks at unprecedented scale. Voice cloning technology now allows fraudsters to replicate anyone's voice from just a few seconds of audio—gathered from social media videos, voicemails, or public recordings—leading to sophisticated "grandparent scams" where victims receive panicked calls from what sounds exactly like their grandchild claiming they've been arrested or injured in an emergency. These calls are designed to trigger immediate emotional responses, bypassing rational decision-making.trendmicro+3

Deepfake photos and videos have become weaponized for blackmail, catfishing, and executive impersonation, with scammers creating fabricated "evidence" of compromising situations or posing as company CEOs to authorize fraudulent wire transfers. AI chatbots now maintain multiple fake relationships simultaneously in romance scams, learning from conversations to craft increasingly personalized messages that feel authentic, making emotional manipulation more efficient and dangerous than ever before.security+1

Multi-Channel Scam Ecosystems

The most significant shift for 2026 involves multi-channel scams where victims are lured from one platform to another, making the fraud harder to detect and trace. Scammers now seamlessly move conversations from social media or text messages into encrypted chat apps like WhatsApp or Telegram, and then to fraudulent payment pages, creating a journey that feels legitimate at every step. This platform-hopping strategy helps fraudsters evade detection systems and makes it difficult for victims to report the crime, as the scam spans multiple companies' jurisdictions.smallbusinessanswers+1

These campaigns use professional-grade branding and localized smishing kits that make fake delivery notifications from FedEx or UPS, billing alerts from utilities, and subscription renewals from Netflix or Amazon Prime nearly indistinguishable from legitimate communications. The messages often include partial tracking numbers, invoice references, or account details that create false credibility.trendmicro+1

High-Loss Financial Scams

Romance and Investment Fraud

Relationship scams continue to drive the highest financial losses, with AI-generated personas creating complete fake identities—including social media histories, photos, and backstories—while deepfake companions blur the line between real and synthetic interactions. Some victims have reported losing their entire retirement savings after months of carefully orchestrated emotional manipulation.smallbusinessanswers

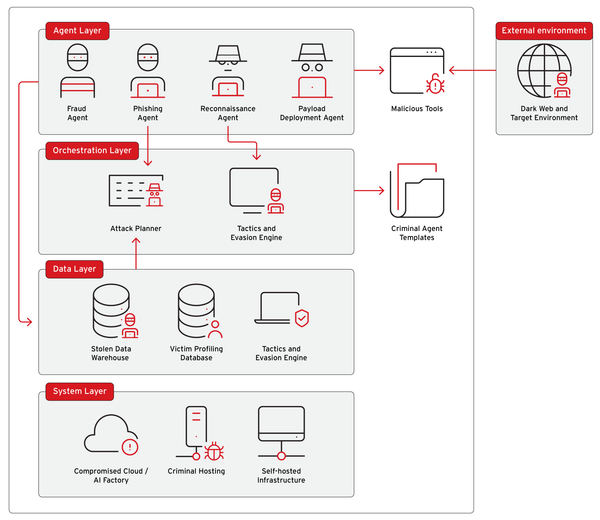

Cryptocurrency investment fraud is expanding through sophisticated scam-as-a-service networks, where organized crime groups provide complete fraud infrastructure—including fake trading platforms, customer service teams, and professional marketing materials—to less technical criminals. These schemes promise guaranteed returns through "exclusive opportunities" in Bitcoin, Ethereum, or newly launched tokens, exploiting the irreversible nature of blockchain transactions. With data showing 50% of crypto users were targeted by scams in recent years, this remains a critical threat area.security+1

Refund Phishing

A newer tactic involves refund phishing, where scammers make fraudulent purchases using stolen credit card information from fake merchants whose names appear as phone numbers or email addresses on your statement. When you call to dispute these mysterious $50-$200 charges, you're actually speaking directly with the scammer who poses as your bank's fraud department and tricks you into sharing additional personal information, account numbers, online banking credentials, or one-time passcodes. This double-layered approach turns a small fraudulent charge into complete account compromise.experian

Employment and Peer-to-Peer Payment Scams

Job scams have become so prevalent that the National Anti-Scam Centre released a dedicated report in May 2025 highlighting the threat. These scams typically advertise high-paying remote positions on legitimate job boards, require upfront payment for "training materials," "background checks," or "equipment," or involve fake interviews where fraudsters install remote access apps like AnyDesk or TeamViewer under the guise of technical assessments to harvest sensitive data from your computer.scamwatch+2

Other job scam variations include fake check schemes where you're hired as a "mystery shopper" or "payment processor," asked to deposit checks and send portions back, only to discover the checks were fraudulent and you're liable for the full amount. Peer-to-peer payment fraud is surging as criminals exploit platforms like Venmo, Cash App, and Zelle, using fake goods, services, rental properties, or emergency scenarios to convince victims to send irreversible transfers. Remember: these platforms operate like cash—once sent, the money is gone.security

Vehicle and Insurance Fraud

Vehicle scams have exploded on Facebook Marketplace, Craigslist, and Instagram, with fraudsters creating fake listings for non-existent vehicles at below-market prices and pressuring buyers to send deposits through wire transfer or cryptocurrency without viewing the vehicle in person. Red flags include sellers claiming to be "out of the country" or using "shipping services," unwillingness to video chat showing the actual VIN number, and payment methods that can't be reversed.restless

Ghost broking targets insurance shoppers through competitive offers on legitimate-looking websites or social media ads, where scammers either forge insurance documents entirely or take out real policies using your information that they immediately cancel after collecting premiums, leaving you unknowingly uninsured and potentially liable for serious legal consequences if you're involved in an accident. These scams are particularly dangerous because victims may not discover the fraud until they file a claim or are pulled over by police.restless

Protecting Yourself in 2026

The old warning signs no longer work in an AI-enhanced fraud landscape. Instead of relying on spotting poor spelling or suspicious formatting, adopt a "verification-first" approach for 2026:trendmicro+1

- Verify identities through multiple channels before taking action on urgent requests—if your "boss" emails asking for gift cards, call them at their known number

- Never trust voice or video alone—establish a secret family code word that only real family members know to use during emergency calls

- Cross-check payment requests by contacting the person or company directly through known, official channels listed on their website or your account statements, never numbers provided in the message

- Be skeptical of job offers requiring upfront payment, offering unusually high pay for simple tasks, or requesting remote access software installation

- Research vehicles and insurance brokers thoroughly through DMV records, BBB ratings, and state insurance department databases before sending any money

- Understand pressure tactics—legitimate companies never force immediate action, threaten account closure, or demand specific payment methods like gift cards, crypto, or wire transfers

- Use verification tools like reverse image search for profile photos, URL checkers for suspicious links, and two-factor authentication for all financial accounts

- Monitor financial statements weekly for small unauthorized charges that could indicate testing before larger fraud

Looking Ahead

2026 represents a turning point where scams operate as AI-scaled ecosystems rather than individual attempts. Fraudsters can now generate thousands of personas, write personalized messages in any language, and shift conversations across multiple platforms more efficiently than ever before. The sophistication means that anyone—regardless of age, education, or technical expertise—can become a victim.trendmicro+2

Staying informed about these evolving tactics, questioning even convincing communications, and implementing modern verification practices are your best defenses in an increasingly deceptive digital world. Remember: if something feels urgent, pressured, or too good to be true, take a step back and verify independently before taking any action. Trust your instincts—feeling uncomfortable about a request is often your subconscious detecting inconsistencies. When in doubt, hang up, delete the message, and contact the supposed sender through verified channels.trendmicro+1

Protect yourself, protect your community—share this guide with friends and family who may be vulnerable to these emerging threats.

- https://www.smallbusinessanswers.com.au/news/scams-set-to-dominate-2026/

- https://www.trendmicro.com/en/about/newsroom/local-press-releases/au/2025/2025-12-05.html

- https://www.experian.com/blogs/ask-experian/the-latest-scams-you-need-to-aware-of/

- https://www.security.org/scams/prevention/

- https://www.trendmicro.com/en/about/newsroom/local-press-releases/nz/2025/2025-12-05.html

- https://www.scamwatch.gov.au/research-and-resources/scams-awareness-week-2025/scams-awareness-week-2025-stakeholder-kit

- https://www.reddit.com/r/IsThisAScamIndia/comments/1mo4tza/dont_get_scammed_in_2025/

- https://restless.co.uk/money/everyday-finance/latest-scams-to-watch-out-for/